Gain access to new revenue

by building bridges for b2b e-commerce

Enterpay offers the most advanced white-labelled solution for banks to generate revenue from invoice payments in the B2B e-commerce space.

The window of opportunity is now open and we CAN help you enter it

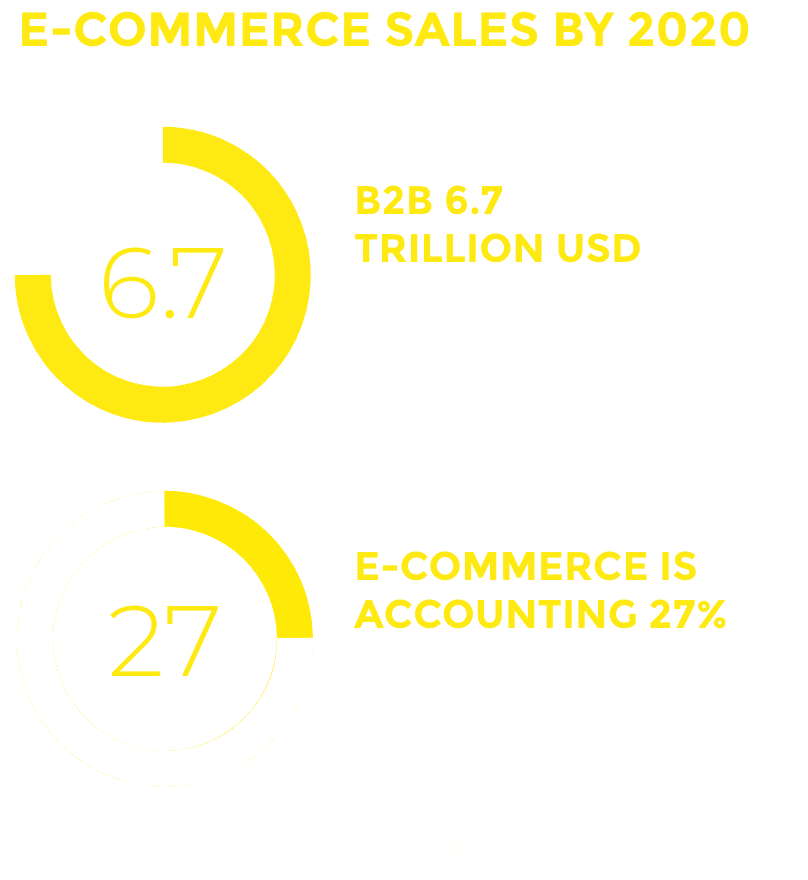

According to research done by Netcomm, more than 50% of B2B merchants demand solutions that reduce purchasing time and simplify payment processes online. The number of B2B buyers that want to purchase online is expected to explode within the next couple of years, and every actor in the ecosystem must be ready to adapt. Players seeking for growth should enter the business now, because the window of opportunity will be closed soon. Enterpay’s solution enables banks to enter a rapidly growing marketplace fast and efficiently.

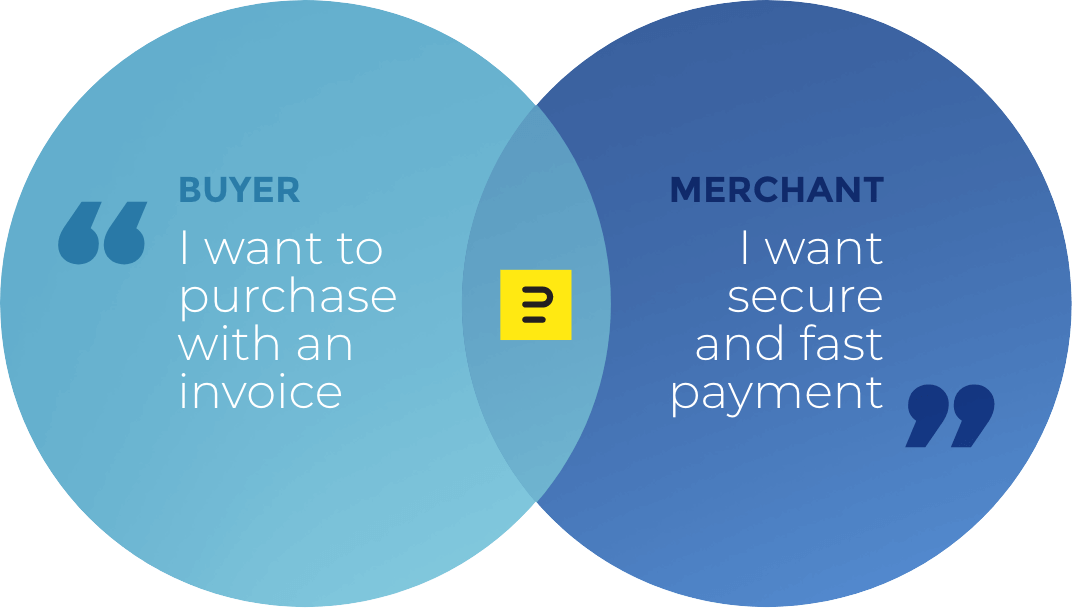

Creating value and profit by managing the merchant’s risk

Invoicing is the preferred payment method in B2B e-commerce but it is potentially risky for merchants. Extracting the financier risk management from merchants and reallocating it to the banks can add value and convenience to customers’ lives . The merchant receives the payment fast and securely, while the buyer saves time and money.

By developing a product that accounts for the financier risk, banks can generate additional revenue streams through transactional revenues and fees on financing payments.

THE PAYMENT SOLUTION

factoring + online decision making + payment gateway

By combining Enterpay’s decisioning engine with banks’ existing invoicing and factoring services, a new B2B payment product is created. VR Payment, a German payment subsidiary of Volksbanken Raiffeisenbanken, has already embraced Enterpay’s solution, which has enabled them to extend and complement its B2B e-commerce services by offering a secure online invoicing payment method and managing the financier risk on behalf of its B2B merchant customers.

Simplifying the process

with our smart decision engine

Enterpay’s decision engine enables banks to offer their customers a risk-free B2B invoice solution. This lends credibility to the payment processes and cuts out a significant risk by automating processes that have previously been done manually by humans. Enterpay’s intelligent decision engine makes an automated credit decision online based on combining the following three variants:

WHO IS BUYING?

Enterpay identifies the person who is buying, checks the purchase history and discovers the connection between the buyer and the company. Enterpay’s solution enables a large variety of buyers to use the B2B invoice, including those without procuring rights, due to its unique way of identifying the connection between the buyer and the company.

WHAT IS BOUGHT?

Enterpay’s decision engine compares the riskiness and value of the items bought by evaluating the shopping cart.

TO WHICH COMPANY ARE THE ITEMS BOUGHT?

Enterpay uses several data points to determine the creditworthiness of the company and compares this to the former two variants.

WHO IS BUYING?

Enterpay identifies the person who is buying, checks the purchase history and discovers the connection between the buyer and the company. Enterpay’s solution enables a large variety of buyers to use the B2B invoice, including those without procuring rights, due to its unique way of identifying the connection between the buyer and the company.

WHAT IS BOUGHT?

Enterpay’s decision engine compares the riskiness and value of the items bought by evaluating the shopping cart.

TO WHICH COMPANY ARE THE ITEMS BOUGHT?

Enterpay uses several data points to determine the creditworthiness of the company and compares this to the former two variants.

REFERENCES

INTEGRATION ABILITY

Enterpay can integrate the B2B invoice product into the webshops and provide access to where the transactions actually happen. Several PSP:s rely on and has partnered with Enterpay:

OUR CUSTOMERS AND PARTNERS

ABOUT US

Founded in 2013 in Helsinki, Finland, Enterpay is a fintech start-up with an international outlook. The team mixture of both strong experience in finance and payments and technical know-how and has innovation and collaboration at its core. We have partners among the leading Nordic businesses in credit management, invoicing and finance. We believe that the best in the business should bring their knowledge together.

OUR VISION

E-commerce is here to stay and buyers making purchases for their businesses are already used to the ease of B2C e-commerce and will expect the same level of customer experience in B2B webstores as well. Purchases in the business world will shift more and more to the online sphere and the merchants must be able to keep up with the needs of the customer. Customer experience is not something to be looked down in B2B commerce.

OUR MISSION

Our mission is to foresee the future challenges of B2B e-commerce and provide the best solutions. We want to equip the merchants with the tools to enhance customer experience, speed up selling and buying processes and hence upscale their sales. Invoice is the easiest payment method for the buying company but the credit assessment process is a time-consuming and high-risk process. Luckily enough, we have a solution.

OUR TEAM

Our team is a happy mixture of both strong experience in finance and payments and technical know-how. This combination enables us to provide services designed to ever better meet the needs of the customer.

Jarkko Anttiroiko

Tapio Vepsäläinen

Nikita Tarutin

RECENT BLOG POSTS

CONTACT US

Get in touch to learn more about our solution and how collaboration with us could benefit your business. We are looking forward to meet you!

Jarkko Anttiroiko

jarkko.anttiroiko@enterpay.fi

You can also leave your details and we will contact you as soon as possible.

Entercheck Ltd.

Konepajankuja 1

00510 Helsinki

Finland

© 2023 Enterpay | A Product of Entercheck Ltd.